India, becoming a signatory to the Brasilia declaration, plans to bring down the road accidents and its consequent fatalities to a half by 2022. Nevertheless, mishaps on the road are still a prevalent issue. Although, insurance policies for cars have seen a surge in sale for their reimbursement benefits, the issue of third party cover becomes a cause of concern.

Moreover, car owners are confused whether an insurance plan will cover third-party damages in case the mishap is their fault. It is essential to know the coverage provided by a comprehensive and third-party car insurance policy to understand this better.

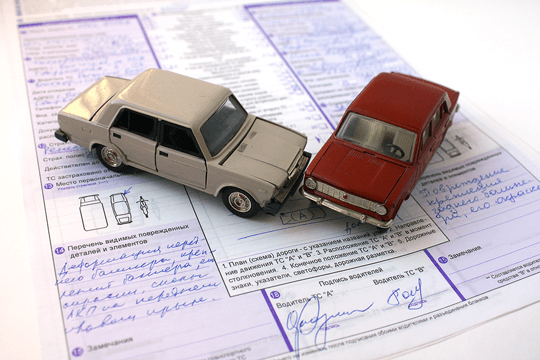

Third party vs comprehensive car insurance

Third party car insurance provides financial coverage to the insured against any damage to property, bodily injuries, or death sustained by the third party if an accident or mishap occurs.

However, damage to the insured’s car remains outside the purview of this type of vehicle insurance plan. As for comprehensive car insurance policy, it is a more extensive solution. Along with financial damages suffered by a third party, it also provides coverage against damages to the insured’s car.

So, when your concern remains as to which car insurance plan you should go for in case you want financial immunity against third-party damages, insurance plan against third party damages is the choice to go for. But a comprehensive car insurance policy offers a greater scope of protection and covers both you against both own damage and damages or losses caused to a third-party.

What does a third-party car insurance policy cover in case of an accident?

If your vehicle has a third-party insurance policy, the following things are covered under the policy:

Damages or losses caused to a third-party by your vehicle

As the insurance provider compensates damages caused to the third party in case of an accident, you remain protected against any financial liability. It covers all types of damages to the vehicle, loss of life, or injuries suffered by a third party, thus, making it a comprehensive insurance plan.

Bajaj Finserv brings you one such complete solution to all your third-party liabilities in case of a car accident in the form o third party insurance plan.

- You get a safety net for your savings

As third-party accident liabilities are on the rise, it may lead to huge expenses depleting your savings if you are not insured. Having a third-party vehicle insurance policy means a safety net that won’t let financial liabilities break your savings.

- It comes with an easy settlement of the claim

In case an accident causes damages to the third party, insurers provide hassle-free settlement of a claim with a specific team dedicated for the purpose.

- Availability of add-on covers

Along with a third-party car insurance policy, you may also choose an add-on cover for your car. For instance, you may opt for the Key Replacement Insurance plan, wallet care, etc. offered by Bajaj Finserv under its Pocket Insurance.

Note that the Motor Vehicles Act, 1988, makes it mandatory for car owners to have a third-party car insurance. A third-party car insurance policy is generally cheap, but one must still go for a car insurance as it offers a greater scope of protection.

You may compare various car insurance policies available in the market based on various factors. You will get a better insight as to which one suits your needs more appropriately. Also, approach a reputed insurance provider to avail the best coverage on your insurance policy.